Introduction – From Cash Registers to Smart Business Hubs

Walk into any modern store, café, or even a small kiosk today, and you will notice one common element—the Point of Sale (POS) system. What once began as a simple cash register used for collecting payments has now evolved into a powerful business management hub that connects sales, inventory, customer data, and even marketing. The journey of POS technology reflects not only the advancement of hardware and software but also the way businesses themselves have transformed in the digital age.

In this deep-dive article, we will explore the evolution of POS systems, from their origins in the 19th century to the modern, AI-powered, cloud-based platforms that define the 21st century. By the end, you’ll understand why POS is no longer “just a payment tool” but the heartbeat of any successful business.

The Early Days of POS – The Birth of Cash Registers . The Evolution of POS Systems

The story of POS technology begins in 1879, when James Ritty, a saloon owner from Ohio, invented the first mechanical cash register. His motivation was simple: prevent employees from stealing profits. This invention laid the foundation for a new era in retail operations.

By the late 1800s, the National Cash Register Company (NCR) mass-produced mechanical registers, making them common in stores across the United States and eventually worldwide. These machines were bulky, noisy, and purely mechanical, but they solved a critical business problem—trust and accountability at the point of sale.

While early registers did little beyond recording sales, they were revolutionary for their time. They introduced the concept of a “point of sale” as a specific place where transactions were securely recorded.

Digital Transformation – The Rise of Electronic POS

By the 1970s and 1980s, the invention of computers and barcode scanners transformed retail operations. The first electronic POS (EPOS) systems emerged, enabling businesses not just to record sales but also to track inventory and generate receipts.

This was a major turning point because businesses could now:

- Monitor stock levels in real-time.

- Automatically update prices and records.

- Integrate with early accounting software.

By the 1990s, major retailers like Walmart and Tesco invested heavily in POS systems, setting a new global standard. Small businesses also began adopting PC-based POS software that allowed them to manage sales more efficiently.

Cloud-Based POS Systems – A Game Changer

The next evolution came with the rise of the cloud in the late 2000s. Traditional POS systems stored data locally on computers, which meant businesses risked data loss and had limited accessibility. Cloud POS systems changed everything by storing sales and inventory data online.

Advantages of Cloud POS include:

- Remote Access: Owners can check reports from anywhere, even on a smartphone.

- Scalability: Start small, expand without new hardware investments.

- Integration: Connect easily with e-commerce platforms, CRMs, and payment gateways.

- Security: Cloud providers offer high-level encryption and backups.

According to Fortune Business Insights, the global POS market is projected to reach $181.5 billion by 2030, driven largely by cloud adoption.

Mobile POS (mPOS) and Tablet Revolution .The Evolution of POS Systems

The rise of smartphones and tablets gave birth to mobile POS (mPOS) systems. Instead of relying on expensive desktop setups, businesses could now accept payments with a tablet, smartphone, or handheld device.

Companies like Square, Shopify POS, and Toast led this transformation, empowering small businesses, food trucks, and pop-up shops to run professional POS systems at a fraction of the cost.

Benefits of mPOS:

- Highly portable.

- Lower setup costs.

- Faster transactions.

- Seamless customer experience.

Restaurants, for instance, use iPad POS systems where waiters can take orders at the table, reducing errors and improving service speed.

AI and Machine Learning in POS Systems

Today’s POS systems are not just about recording sales—they are intelligent business assistants. With AI and machine learning, POS systems can:

- Predict future sales trends using historical data.

- Optimize inventory by automatically reordering items before they run out.

- Analyze customer behavior to recommend personalized promotions.

- Detect fraud by spotting unusual transaction patterns.

For example, an AI-driven POS might suggest stocking more iced drinks in summer based on sales history, or warn of suspicious purchases that could indicate credit card fraud.

Security and Compliance – Protecting Transactions .The Evolution of POS Systems

As POS systems advanced, so did cybersecurity threats. POS terminals handle sensitive data such as credit card numbers and personal customer information, making them prime targets for hackers.

Modern POS systems comply with PCI DSS standards, ensuring encrypted transactions and secure storage. Additional security features include:

- End-to-end encryption (E2EE)

- Two-factor authentication

- Automatic software updates

- Advanced firewalls and malware protection

In an era where digital trust is everything, security is no longer optional—it is a must for every POS provider.

Omnichannel POS – Beyond the Counter .The Evolution of POS Systems

Modern customers shop across multiple channels—online, in-store, and even through social media. This gave rise to omnichannel POS systems that unify all sales channels into one central platform.

With omnichannel POS, a business can:

- Track inventory across both online and offline stores.

- Allow customers to order online and pick up in-store (BOPIS).

- Offer consistent loyalty rewards across platforms.

- Sync promotions across e-commerce, apps, and physical outlets.

This seamless integration ensures a smooth customer journey regardless of where the transaction begins.

Must-Have Features of Modern POS Systems

The POS of today goes far beyond processing payments. Businesses now demand features such as:

- Loyalty and Rewards Programs to encourage repeat purchases.

- Employee Management Tools for tracking shifts and productivity.

- Advanced Reporting and Analytics for real-time insights.

- CRM Integration to personalize customer relationships.

- Multiple Payment Options including mobile wallets, QR codes, and cryptocurrencies.

A POS system that lacks these capabilities risks falling behind in today’s competitive market.

Case Studies – Real World Impact of POS

- Retail: H&M and Zara use POS systems connected to global supply chains, ensuring accurate stock availability worldwide.

- Restaurants: Starbucks uses a POS that integrates with its loyalty app, mobile orders, and in-store payments, creating a seamless experience.

- Healthcare: Clinics and pharmacies now rely on POS systems for both billing and storing sensitive patient data.

- Small Business: Local cafés use Square POS to run professional operations without heavy costs.

The Future of POS Technology .The Evolution of POS Systems

As technology advances, POS systems will continue to evolve. Future trends include:

- Blockchain Payments: Faster, cheaper, and more secure transactions.

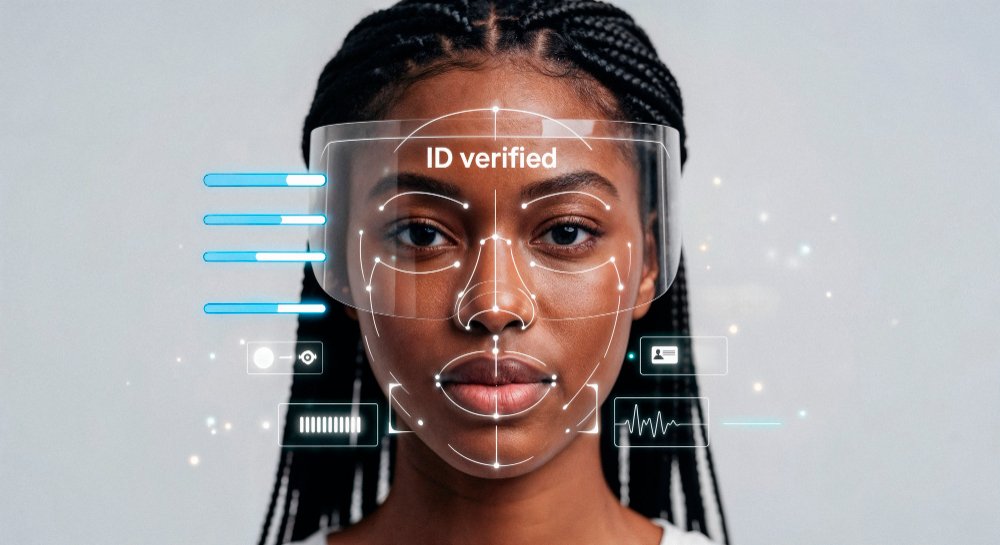

- Biometric Authentication: Fingerprint or facial recognition replacing PIN codes.

- Augmented Reality (AR) Shopping: Customers making payments within AR environments.

- Voice-Activated POS: Hands-free order taking and payment processing.

In essence, POS will become more than just a tool—it will be an ecosystem connecting finance, operations, marketing, and customer experience.

Conclusion – More Than Just Payments

The journey of POS systems reflects the transformation of business itself. From clunky mechanical registers to sleek AI-driven platforms, POS has become the central nervous system of commerce.

Businesses that embrace modern POS solutions gain access to better insights, stronger customer relationships, and streamlined operations. Those that fail to adapt risk being left behind in an increasingly digital, customer-centric marketplace.

In today’s world, a POS system is not just about “where you pay”—it is about how businesses grow, connect, and compete.